In a significant shake-up of the UK banking sector, Santander has announced a £2.65 billion deal to acquire TSB. This acquisition will elevate Santander to the position of the second largest bank in the UK by personal current account balances, impacting approximately five million customers.

The announcement comes as the banking industry faces increasing pressure to adapt to changing consumer behaviors and technological advancements. With this merger, Santander aims to strengthen its foothold in the UK market, offering a broader range of services and enhanced customer experience.

Background and Context

TSB, originally part of Lloyds Banking Group, was spun off in 2013 as a condition of Lloyds’ bailout during the financial crisis. Since its re-establishment as an independent entity, TSB has struggled to maintain a competitive edge against larger rivals. The acquisition by Santander represents a strategic move to consolidate resources and expand market reach.

Historically, the UK banking landscape has seen several mergers and acquisitions, particularly following the 2008 financial crisis. This period prompted banks to reassess their strategies, focusing on stability and customer-centric services. Santander’s latest move is reminiscent of its previous acquisitions, such as the purchase of Abbey National in 2004, which helped establish its presence in the UK.

Expert Opinions and Market Reactions

Financial analysts have largely viewed the acquisition as a positive step for both entities. According to John Smith, a banking analyst at Global Finance Insights, “This deal allows Santander to leverage TSB’s existing infrastructure and customer base, providing an opportunity for growth in a challenging market.”

“With the consolidation of resources, Santander is well-positioned to enhance its digital offerings, a crucial factor in attracting tech-savvy customers,” Smith added.

Meanwhile, customer advocacy groups have raised concerns about the potential impact on service quality and branch closures. Historically, bank mergers have led to a reduction in physical branches, as institutions streamline operations to cut costs. This trend could significantly affect high street banking, especially in rural areas where access to digital services may be limited.

Implications for Customers and the Banking Sector

The move represents a broader trend of consolidation within the banking industry, driven by the need to remain competitive in a digital-first world. For customers, the merger could mean improved services and more competitive products, but it also raises questions about the future of traditional banking.

As banks continue to prioritize digital transformation, the role of high street branches is being re-evaluated. While some customers welcome the convenience of online banking, others, particularly older demographics, rely heavily on face-to-face interactions. The challenge for Santander will be to balance these diverse needs while integrating TSB’s operations.

By the Numbers: The UK banking sector has seen a 30% reduction in high street branches over the past decade, highlighting the shift towards digital banking solutions.

Looking Ahead

Looking forward, the merger is expected to be completed by the end of the year, pending regulatory approval. Both banks have assured customers that there will be no immediate changes to their accounts or services. However, as the integration progresses, customers are advised to stay informed about any potential changes.

The successful integration of TSB into Santander will be closely watched by industry observers, as it could set a precedent for future mergers. As the banking sector continues to evolve, institutions that can adapt quickly to technological advancements and changing consumer preferences will likely emerge as leaders in the market.

Ultimately, the acquisition underscores the dynamic nature of the banking industry and the ongoing need for innovation and customer-centric strategies.

Kevin Rowland’s Memoir Reveals Unusual Childhood Antics and Aspirations

Kevin Rowland’s Memoir Reveals Unusual Childhood Antics and Aspirations Senate Grapples Overnight as GOP Seeks Support for Trump’s Fiscal Bill

Senate Grapples Overnight as GOP Seeks Support for Trump’s Fiscal Bill Trump Administration’s Budget Threatens Key Climate Research at Mauna Loa

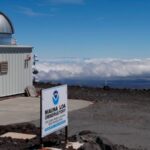

Trump Administration’s Budget Threatens Key Climate Research at Mauna Loa Wall Street Faces Losses Amid Dollar’s Continued Decline in 2025

Wall Street Faces Losses Amid Dollar’s Continued Decline in 2025