As gold and silver prices continue to soar, many individuals are looking to cash in by selling their old jewelry. However, navigating the bustling New York City Diamond District to secure the best deal can be daunting. Experts emphasize the importance of thorough research before selling valuable items like an uncle’s old Rolex or a grandmother’s brooch.

New York City’s Diamond District is renowned for its maze of kiosks and fast-talking specialists. Despite its intimidating atmosphere, it is the largest of the U.S.’s four major jewelry districts, offering a competitive market for sellers. According to diamond analyst Paul Zimnisky, “I would recommend going to larger, more active markets, like 47th Street in New York or Jewelers’ Row in Philly so you can more easily get multiple offers to compare.”

Preparing to Sell: Research and Recommendations

Before heading to the Diamond District, it’s crucial to gather information and seek recommendations. Alon Mirzaev, co-owner of US Gold Refinery, highlights the power of word-of-mouth: “A lot of our business is word of mouth.” Consulting friends and colleagues who have previously traded their gold can provide valuable insights.

Online reviews on platforms like Google and Yelp can also guide sellers. Lee Edelman, a precious metals processor and trader, advises, “Make sure you don’t go to someone who has a bad ranking on BBB.” These reviews can help avoid businesses with poor reputations.

Shopping Around for the Best Offer

Once equipped with recommendations, experts suggest visiting multiple storefronts to compare offers. Lee Edelman recommends, “If you have a fair amount of gold or silver to sell, go to at least three places.” In New York, ensure that these are licensed “precious metals dealers” by the city’s Department of Consumer and Worker Protection, which speaks to a business owner’s honesty.

Licensed dealers are required to hold onto items for at least two weeks to ensure they are not stolen, and sellers must provide a government-issued ID. Ben Tseytlin of Bullion Exchanges notes, “If you are selling stolen goods you are not going to come to my business.”

Understanding Market Prices and Fees

Staying informed about current market prices is essential. Gold prices have recently reached an all-time high of $3,500 in April, with fluctuations occurring daily. Spot prices for gold, silver, and platinum can be found on reputable sites like APMEX or Kitco.

Gold hit an all-time high of $3,500 in April. On Tuesday, it was changing hands at $3,350.

David Gavriel of Fantasy Jewelers advises that transaction fees typically range between 1% and 5%, depending on the deal’s size. “If we are paying $1,000 for a gold bracelet, we might charge a 5% fee, but if we are buying $100,000 of gold, the fee might be between 1% and 2%,” Gavriel said.

For those with multiple items to sell, purchasing a scale to measure in troy ounces is recommended. This allows sellers to verify weights independently, which is crucial in a district with both honest and dishonest dealers.

Evaluating Your Items

Before selling, it’s important to assess whether items are worth more than their weight in gold. Patek-Philippe watches and antique Tiffany pendants are examples of high-value items. Sellers should also ensure that gold coins are not merely commodities to be weighed.

David Gavriel recounts directing a customer to a specialist after identifying a small gold piece worth $300 in gold but likely valued at over $3,000 to a collector. Such evaluations can significantly impact the final sale price.

Timing Your Sale

Timing can also affect the sale outcome. Mirzaev advises sellers seeking cash to visit earlier in the day due to banking limits on hard currency. “Come in earlier in the day to ensure that you get cash if that’s what you need,” he says. However, for transactions exceeding $2,500, cash payments may not be available.

“We don’t give cash for anything over $2,500,” says Tysetlin.

By following these expert tips, sellers can navigate the complexities of the Diamond District and maximize their returns on gold and silver sales. As the market continues to fluctuate, staying informed and prepared is more crucial than ever.

Tesla’s Sales Dip Amid Shift to Autonomous Driving Focus

Tesla’s Sales Dip Amid Shift to Autonomous Driving Focus NYT Connections July 2, 2025: Unraveling the Puzzle’s Complex Themes

NYT Connections July 2, 2025: Unraveling the Puzzle’s Complex Themes Affordable Luxury: Top Smart TVs Under ₹70,000 in 2025

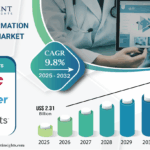

Affordable Luxury: Top Smart TVs Under ₹70,000 in 2025 Global Health Information Exchange Market to Surge, Projected to Reach $4.44 Billion by 2032

Global Health Information Exchange Market to Surge, Projected to Reach $4.44 Billion by 2032 US Stocks Drift as Wall Street Awaits Crucial Jobs Report

US Stocks Drift as Wall Street Awaits Crucial Jobs Report