Elon Musk’s recent political maneuvers are casting a shadow over Tesla’s performance, as the electric vehicle giant braces for another quarter of declining sales. The anticipated report, due Wednesday, is expected to reveal a 13% drop in sales compared to the same period last year. This comes amid increased competition in the EV market and reputational challenges linked to Musk’s political affiliations.

Despite stepping down from his role as a special government adviser to focus on Tesla, Musk remains embroiled in political disputes. His recent clash with former President Donald Trump over a controversial tax and spending bill has further fueled investor concerns. Musk’s outspoken criticism of the legislation, which he labeled “insane,” prompted Trump to suggest potential investigations into Musk’s companies’ government contracts.

The Impact of Political Drama on Tesla

Wedbush analyst Dan Ives, a long-time supporter of Tesla, highlighted the detrimental impact of Musk’s political engagements on the company’s stock. “Tesla investors want Musk to focus on driving Tesla and stop this political angle,” Ives stated in a note to clients. He warned that being on Trump’s bad side could have serious repercussions for Tesla’s future.

As Tesla’s sales continue to decline, the company’s financial health is also under scrutiny. The first quarter saw a staggering 71% drop in net income, with Tesla relying heavily on the sale of regulatory credits to maintain profitability. If Trump’s spending bill passes, these credits could disappear, posing a significant threat to Tesla’s bottom line.

Challenges Beyond Sales

Beyond declining sales, Tesla faces a myriad of challenges. The much-anticipated Cybertruck has failed to meet expectations, and the company’s showrooms have been the site of numerous protests. A recent Electric Vehicle Intelligence Report indicates that both Republicans and Democrats are now less inclined to purchase a Tesla, a sentiment exacerbated by Musk’s political associations.

Furthermore, Tesla’s core business of selling cars is underperforming. The company reported a profit of $409 million last quarter, largely due to $595 million in regulatory credit sales. Without these credits, Tesla would have posted a loss, underscoring the precariousness of its financial position.

Market Reaction and Future Outlook

The ongoing Musk-Trump feud has not gone unnoticed by the market. Tesla shares dropped 2% on Monday as the conflict reignited and fell another 5% on Tuesday, even as the broader stock market rallied. This decline highlights the growing investor unease surrounding Musk’s political entanglements.

Despite the challenges, there are signs that Musk may be reconsidering his approach. Following a provocative comment from Trump about DOGE, a committee Musk established to reduce federal bureaucracy, Musk hinted at restraint. “So tempting to escalate this. So, so tempting,” he wrote on X. “But I will refrain for now.”

As Tesla navigates these turbulent times, the company’s future hinges on Musk’s ability to refocus on its core mission. Investors and analysts alike are watching closely, hoping for a resolution that will steer Tesla back on course and restore confidence in its leadership.

About The Author

Macao’s Casino Industry Unshaken by Emerging Asian Gambling Hubs

Macao’s Casino Industry Unshaken by Emerging Asian Gambling Hubs Bridging the Gap: Real-World Data in Clinical Trials

Bridging the Gap: Real-World Data in Clinical Trials Trump’s Domestic Policy Bill Faces Crucial Test in Divided House

Trump’s Domestic Policy Bill Faces Crucial Test in Divided House India Seeks to Cut Dependency on Chinese Raw Materials Amid Strategic Shift

India Seeks to Cut Dependency on Chinese Raw Materials Amid Strategic Shift Surge in Dengue Cases Signals New Normal as Mosquito Season Peaks

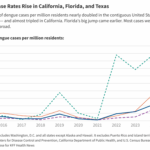

Surge in Dengue Cases Signals New Normal as Mosquito Season Peaks