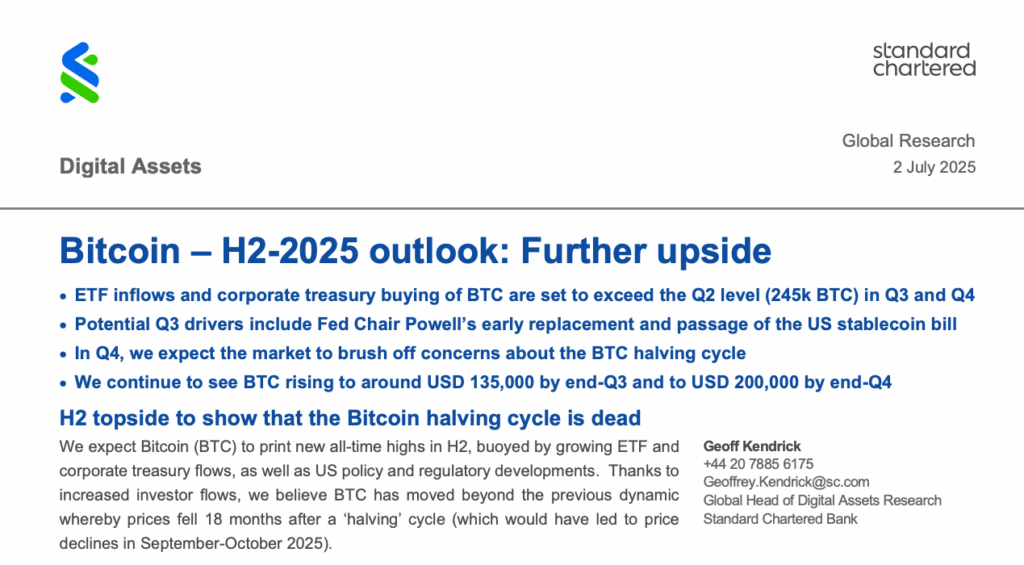

Global banking giant Standard Chartered has expressed a bullish outlook on Bitcoin for the remainder of the year, driven by increasing corporate treasury acquisitions and robust exchange-traded fund (ETF) inflows. According to Geoff Kendrick, the head of digital asset research at Standard Chartered, Bitcoin is expected to reach new heights of $135,000 by the end of the third quarter and could potentially surpass $200,000 by the year’s end. This optimistic forecast was detailed in a report shared with Cointelegraph on Wednesday.

Kendrick noted, “Thanks to increased investor flows, we believe BTC has moved beyond the previous dynamic whereby prices fell 18 months after a ‘halving’ cycle.” Traditionally, Bitcoin’s price has seen declines following halving events, which occur approximately every four years, reducing the mining reward by 50%. However, Kendrick suggests that the common halving trend, which would have led to price declines in September or October 2025, is no longer applicable.

Understanding the Halving Cycle

Bitcoin halving events have historically been significant for the cryptocurrency, often leading to price spikes followed by corrections. The last two halving cycles in 2016 and 2020 resulted in Bitcoin prices dropping approximately 18 months post-halving. However, Kendrick argues that the upcoming halving in April 2024 will likely deviate from this pattern due to new market drivers such as strong ETF inflows and increased corporate buying.

“We expect prices to resume their uptrend, supported by continued strong ETF and Bitcoin treasury buying,” Kendrick stated in the report. He emphasized that these factors were not present during previous halving cycles, indicating a shift in market dynamics.

ETF Inflows and Market Dynamics

The bullish sentiment from Standard Chartered coincides with a recent trend of ETF inflows turning negative after 15 consecutive days of positive movement. Data from SoSoValue revealed that US spot Bitcoin ETFs experienced outflows totaling $342.3 million on Tuesday, marking the first outflows since June 6. These outflows represented 7% of the total $4.8 billion inflows recorded over the 15-day period.

According to Kendrick, Bitcoin ETF flows and corporate treasury buying reached 245,000 BTC in Q2. “We expect that level to be exceeded in both Q3 and Q4,” he added.

Implications for Bitcoin’s Future

The latest report from Standard Chartered reinforces the bank’s confidence in Bitcoin’s long-term potential, projecting a price of $500,000 per coin by 2028. This forecast highlights the evolving landscape of cryptocurrency investments and the increasing institutional interest in digital assets.

While the bank remains optimistic, it acknowledges potential volatility in the market. “We still don’t rule out that the price could be somewhat choppy in late Q3 and early Q4 amid concerns about the correction pattern from the previous halvings,” Kendrick cautioned.

Expert Opinions and Market Reactions

Experts in the field have noted the significance of institutional investments in shaping Bitcoin’s trajectory. The growing acceptance of Bitcoin ETFs and corporate treasury acquisitions are seen as major catalysts for price stability and growth.

Meanwhile, the cryptocurrency community remains divided on the impact of halving events. Some analysts argue that the reduced supply will inevitably lead to price increases, while others believe that market maturity and external factors will play a more significant role in determining Bitcoin’s future value.

Looking Ahead

As Bitcoin approaches its next halving event in 2024, market participants will be closely monitoring the interplay between traditional halving dynamics and new market drivers. The potential for Bitcoin to reach unprecedented price levels by the end of the year underscores the importance of understanding these evolving trends.

Standard Chartered’s predictions, while optimistic, serve as a reminder of the inherent volatility and unpredictability of the cryptocurrency market. Investors and analysts alike will be watching closely to see if Bitcoin can indeed defy historical patterns and achieve new milestones in the coming months.

About The Author

Key Developments to Watch on July 2, 2025

Key Developments to Watch on July 2, 2025 Revolutionary 9,000mAh Batteries Set to Transform Smartphones by 2026

Revolutionary 9,000mAh Batteries Set to Transform Smartphones by 2026 Why a VPN is Essential for Secure Travel in the Digital Age

Why a VPN is Essential for Secure Travel in the Digital Age Ironheart Finally Brings Mephisto to the MCU, Almost Didn’t Happen

Ironheart Finally Brings Mephisto to the MCU, Almost Didn’t Happen Gemini’s Potential RCS Support Could Revolutionize Messaging

Gemini’s Potential RCS Support Could Revolutionize Messaging