As the year progresses with its fair share of economic turbulence—wars, tariffs, volatile cryptocurrencies, and shifting interest rates—many individuals find themselves overwhelmed by the constant flow of news. However, amidst this chaos, there is one area where you can exert some control: your personal finances. Here are six strategic steps to help you make informed money moves as we reach the mid-year mark.

Review and Adjust Your Spending

The first step is to take a close look at your spending habits from the first half of the year. If you haven’t been using a financial app, now is the time to pull out your bank statements and credit card bills. You may find that returning to the office five days a week has led to increased spending on lunches, or that your streaming services have surpassed the cost of the cable bundle you once abandoned. The objective is to identify areas where spending can be curtailed and redirected towards savings or debt repayment.

Be Wary of Hidden Fees

Hidden fees are a common pitfall in personal finance, designed to confuse or deceive consumers. Despite some regulatory efforts, the near-elimination of the Consumer Financial Protection Bureau (CFPB) means that consumer-facing infractions may not receive the attention they deserve. This places the responsibility on individuals to remain vigilant against bank fees, credit card late payment fees, hotel resort fees, airline baggage and change fees, and service and cable fees. Methodically review your spending categories to identify where these fees typically occur.

Update Your Insurance Policies

Life changes, and so should your insurance coverage. Whether you’ve recently married, divorced, had a child, received a new medical diagnosis, or purchased a home, these milestones can significantly impact your health, auto, home, and life insurance needs. Of particular concern are home/renters’ and car insurance, which have seen substantial increases since the pandemic.

Auto insurance rates have surged by more than 50% since 2020, while home insurance premiums have risen by 24% over three years, according to the Consumer Federation of America.

To mitigate these increases, consider shopping around for better rates, bundling coverage, and exploring discounts for security systems or paying annually. Additionally, evaluate whether dropping collision or comprehensive coverage on older vehicles is a viable option.

Maximize Your Savings and Investments

Despite interest rates peaking three years ago, many savers are still stuck in low-yield accounts. It’s crucial to search for higher-yielding, safe money accounts and request better rates from your financial institutions. Remember, if you don’t ask, you may not receive.

For those with multiple retirement accounts, consider consolidating them to simplify management and rebalancing. If your workplace offers a robust retirement plan, you might be able to roll old accounts into it. Otherwise, select a financial institution with a user-friendly platform. Regularly rebalance your accounts to maintain your desired asset allocation, which often involves selling high-performing assets and buying underperforming ones.

Boost Your Retirement Contributions

If your financial situation allows, consider increasing your retirement savings. The contribution limit for employer-based plans in 2025 is $23,500, with an additional $7,500 for those aged 50 or older. Even a modest one percent increase in your contribution rate can yield significant long-term benefits due to compound growth.

Prepare or Update Your Estate Planning Documents

No mid-year financial review would be complete without addressing estate planning. Ensure your will, power of attorney, and health care proxy are up to date. If hiring an estate attorney isn’t feasible, numerous online resources can guide you through the process.

In conclusion, taking control of your finances amidst economic uncertainty can provide a sense of stability and preparedness. By reviewing spending, guarding against fees, updating insurance, maximizing savings, and ensuring your estate plans are current, you can navigate the remaining months of the year with greater confidence.

Jill Schlesinger, CFP, is a CBS News business analyst. A former options trader and CIO of an investment advisory firm, she welcomes comments and questions at [email protected]. Visit her website at www.jillonmoney.com.

©2025 Tribune Content Agency, LLC. Get the latest local business news delivered FREE to your inbox weekly.

About The Author

Iran Halts Cooperation with UN Nuclear Inspectors Amid Security Concerns

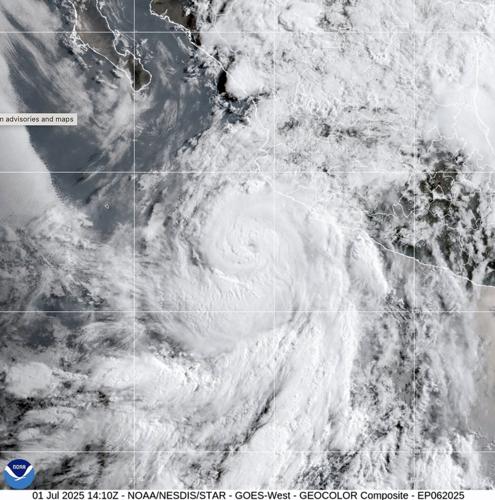

Iran Halts Cooperation with UN Nuclear Inspectors Amid Security Concerns Hurricane Flossie Intensifies to Category 3 Off Mexico’s Coast

Hurricane Flossie Intensifies to Category 3 Off Mexico’s Coast Denmark Expands Military Conscription to Include Women Amid Security Concerns

Denmark Expands Military Conscription to Include Women Amid Security Concerns Italian “Ghost Children” Found in Isolation: Parents Claim Protective Intentions

Italian “Ghost Children” Found in Isolation: Parents Claim Protective Intentions Paramount Settles $16 Million Lawsuit with Trump Over ’60 Minutes’ Interview

Paramount Settles $16 Million Lawsuit with Trump Over ’60 Minutes’ Interview