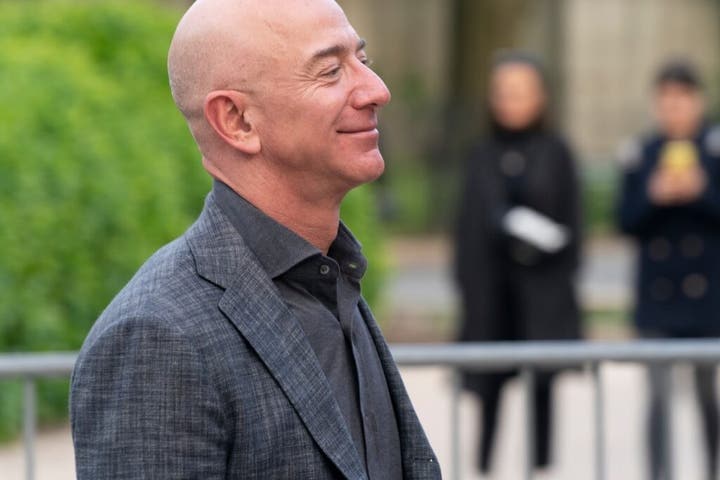

Amazon.com Inc. founder and executive chairman, Jeff Bezos, has sold a significant portion of the company’s shares, valued at $737 million, over three transactions conducted between late last week and early this week. This financial maneuver follows closely on the heels of his extravagant wedding to Lauren Sanchez in Venice, a ceremony that captured global attention.

According to a Securities and Exchange Commission (SEC) Form-4 filing dated July 1, Bezos divested a total of 3,324,926 Amazon shares from June 27 to June 30. The sales were executed as part of a Rule 10b5-1 trading plan, which was adopted on March 4, 2025. This plan allows corporate insiders to sell shares at predetermined times and volumes, thereby mitigating potential accusations of insider trading.

Details of the Stock Sale

The filing reveals that the largest block of more than 3 million shares was sold at a weighted average price of $221.41 on June 27. An additional 16,860 shares were sold on the same day at an average price of $222.39. On June 30, Bezos sold another 224,926 shares at an average price of $223.56, culminating in total proceeds of $737 million.

Despite this substantial liquidation, Bezos remains the largest individual shareholder of Amazon, retaining 905 million shares. At Tuesday’s closing price of $220.46, his holdings are valued at just under $200 billion.

Context and Implications

This financial activity comes just days after Bezos’s high-profile wedding in Venice, which reportedly cost $50 million. The event, attended by numerous celebrities and dignitaries, has been dubbed the “Wedding of the Century.” The timing of the stock sale has raised questions about its connection to the wedding expenses, although there is no official statement linking the two events.

According to a 10-Q filing made two months ago, Bezos plans to sell nearly $5 billion worth of Amazon shares by May 2026. The proceeds from these sales are intended to fund his space exploration company, Blue Origin, among other ventures.

Bezos has a net worth of $240 billion, according to the Bloomberg Billionaires Index, with his Amazon stake comprising a substantial portion of this wealth.

Market Reaction and Future Prospects

Amazon shares showed a slight increase of 0.49% on Tuesday, trading at $220.46, with a marginal uptick of 0.10% in after-hours trading. According to Benzinga’s Edge Stock Rankings, Amazon scores well on growth metrics but less favorably on other factors. However, the stock maintains a positive price trend across short, medium, and long-term horizons.

Industry analysts are closely watching these developments, particularly in light of Bezos’s ongoing investments in Blue Origin and other ventures. The sale of such a significant volume of stock could signal strategic financial planning aimed at diversifying Bezos’s portfolio beyond Amazon.

“This move represents a continuation of Bezos’s strategy to fund his ambitious space projects while maintaining a significant stake in Amazon,” said a market analyst.

Looking Ahead

As Bezos continues to liquidate portions of his Amazon holdings, the market will likely scrutinize how these transactions impact both his personal wealth and the company’s stock performance. The broader implications for Amazon, especially in terms of leadership and strategic direction, remain a topic of interest among investors and analysts alike.

Meanwhile, Bezos’s ventures into space exploration and other industries suggest a broader vision that extends beyond e-commerce. Observers will be keen to see how these efforts unfold and what they might mean for the future of technological innovation and entrepreneurship.

About The Author

Bryan Kohberger Plea Deal Sparks Controversy Among Victims’ Families

Bryan Kohberger Plea Deal Sparks Controversy Among Victims’ Families US Halts Some Munitions Shipments to Ukraine Amid Defense Review

US Halts Some Munitions Shipments to Ukraine Amid Defense Review Mastering Stealth in Death Stranding 2: A Comprehensive Guide

Mastering Stealth in Death Stranding 2: A Comprehensive Guide Federal Judge Halts Early Termination of TPS for Haitian Migrants

Federal Judge Halts Early Termination of TPS for Haitian Migrants The Complex Dynamics of Late Capitalism: Control, Crisis, and Compliance

The Complex Dynamics of Late Capitalism: Control, Crisis, and Compliance