China’s electric vehicle (EV) manufacturer Leapmotor has entered into a significant carbon credit transfer agreement with Italy’s automotive giant Stellantis. This strategic deal allows Stellantis to purchase CO2 credits from Leapmotor, which generates these credits through the production and sale of zero-emission vehicles (ZEVs). This collaboration not only highlights the dual role of EV manufacturers in reducing emissions and generating revenue but also signals the evolving dynamics of the global automotive industry.

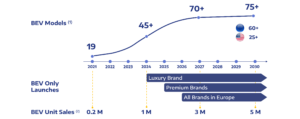

The announcement comes as Stellantis seeks to align with China’s stringent vehicle emission regulations. By acquiring carbon credits from Leapmotor, Stellantis aims to bolster its compliance efforts while advancing its electrification strategy. This move is part of Stellantis’ broader goal to achieve net-zero emissions by 2038, with a significant milestone of rolling out battery electric vehicles (BEVs) by 2030.

Trading Carbon and Cars: Inside the Leapmotor-Stellantis Deal

Leapmotor revealed that its subsidiary, Leapmotor Power, has formalized a carbon credit transfer agreement with Stellantis’ Chinese units. This arrangement enables Stellantis brands, including Fiat and Jeep, to acquire carbon credits from Leapmotor over a multi-year period. Each credit represents one tonne of CO2 avoided by selling an EV instead of a traditional fossil-fuel vehicle.

While specific volumes and pricing details remain undisclosed, both companies have described the agreement as a “landmark” deal. This partnership underscores a growing trend where EV manufacturers increasingly rely on carbon credit sales to enhance their revenue streams and offset operational costs. For Stellantis, this agreement is a strategic step in meeting regulatory requirements while scaling up its electrification strategy in a cost-effective manner.

“The transaction highlights the growing importance of carbon credits in global automotive strategy,” said a Stellantis spokesperson.

Moreover, Leapmotor’s compliance with China’s “Parallel Management Method for Passenger Vehicle Corporate Average Fuel Consumption (CAFC) and New Energy Vehicle (NEV) Credits” policy aligns with the nation’s goals to peak carbon emissions before 2030. This policy incentivizes automakers to improve fuel efficiency and expand NEV output to earn tradable credits.

Turning Emissions Into Earnings: How EVs Mint Carbon Credits

Electric vehicles are pivotal in the global transition to cleaner transportation, not only by reducing tailpipe emissions but also by generating carbon credits. These credits can be traded or sold to companies needing to balance their carbon footprints, providing a significant incentive for automakers to adopt greener practices.

Zero-emission vehicles automatically earn credits under various emissions regulations. Jurisdictions like California, China, and the EU have set ZEV quotas, requiring automakers to ensure a portion of their sales come from EVs. If they fall short, they must purchase credits from companies like Leapmotor that exceed these quotas.

“Tesla is the most notable case, earning $2.76 billion in carbon-credit revenue in 2024, up 54% from 2023,” reported industry analysts.

Since 2017, Tesla has amassed over $10.4 billion from regulatory credit sales, demonstrating how EV-led carbon programs can become lucrative income streams. This revenue supports further investment in clean technology and underscores the financial viability of the EV market.

Leapmotor Cashes In: Joining the Billion-Dollar EV Credit Market

Leapmotor’s agreement with Stellantis positions the company to tap into the burgeoning carbon credit market. As global emissions regulations tighten, the demand for carbon credits is on the rise. For Stellantis, acquiring Leapmotor’s ZEV credits aids in meeting regulatory targets, particularly in Europe, where non-compliance can result in fines of €95 per gram of CO2 per kilometer.

For Leapmotor, this deal provides a stable revenue stream and enhances its financial profile, enabling the company to scale production and reinvest in EV technology and market expansion. However, the EV credit market is not without its challenges. In the U.S., there is ongoing legislative debate about phasing out credit programs, which could impact companies like Tesla that heavily rely on this model.

Analysts caution that as more automakers ramp up EV production, the price of credits may decrease. While Tesla benefited when others lagged, the influx of EVs could weaken credit demand and reduce prices.

What It Means for the EV Market and Carbon Goals

The Leapmotor-Stellantis carbon credit deal exemplifies how traditional and electric carmakers can collaborate to achieve climate targets. It also reflects a broader trend in the EV industry, where clean car companies gain additional revenue streams by selling credits to less electrified counterparts.

For Leapmotor, the deal enhances its credibility and financial flexibility as it expands both domestically and internationally. For Stellantis, the agreement facilitates compliance in the world’s largest auto market while providing time to accelerate its EV rollout.

“Bloomberg forecasts global EV sales to capture 50% of the market by 2030, with China remaining the top market globally,” noted a recent industry report.

As global policies tighten and consumer demand for EVs grows, automakers are likely to explore more creative strategies to manage their carbon footprints. These partnerships emphasize that EVs are more than just clean transportation solutions—they are integral components of the global carbon economy.

Looking Ahead: Leapmotor’s Path to Profit and Sustainability

Leapmotor’s deal with Stellantis not only positions it as an EV innovator but also as an exporter of carbon compliance. As global emissions regulations become more stringent, the ability to generate carbon assets may become a crucial revenue source for the company.

This agreement highlights the transformative impact of electric vehicles on global emissions markets. Automakers that sell EVs can now earn substantial revenue through regulatory credits, while traditional firms meet climate obligations. Tesla’s multi-billion-dollar earnings from credit sales illustrate the lucrative potential of this business model.

As EV sales continue to grow, the competition for credits will intensify. For EV producers, carbon credits offer not just sustainability credentials but also tangible financial value, strengthening their position in the global automotive market and accelerating the transition to net-zero transport.

Top Foldable Phones of July 2025: A Comprehensive Guide

Top Foldable Phones of July 2025: A Comprehensive Guide USAID Funding Cuts Could Threaten Millions Globally, Warns Former Chief

USAID Funding Cuts Could Threaten Millions Globally, Warns Former Chief Ethereum vs MAGACOIN FINANCE: A Battle for Inflation Hedge Supremacy in Q4 2025

Ethereum vs MAGACOIN FINANCE: A Battle for Inflation Hedge Supremacy in Q4 2025 England vs India 2nd Test 2025: How to Watch Live from Anywhere

England vs India 2nd Test 2025: How to Watch Live from Anywhere England vs India 2nd Test 2025: How to Stream Live from Anywhere

England vs India 2nd Test 2025: How to Stream Live from Anywhere