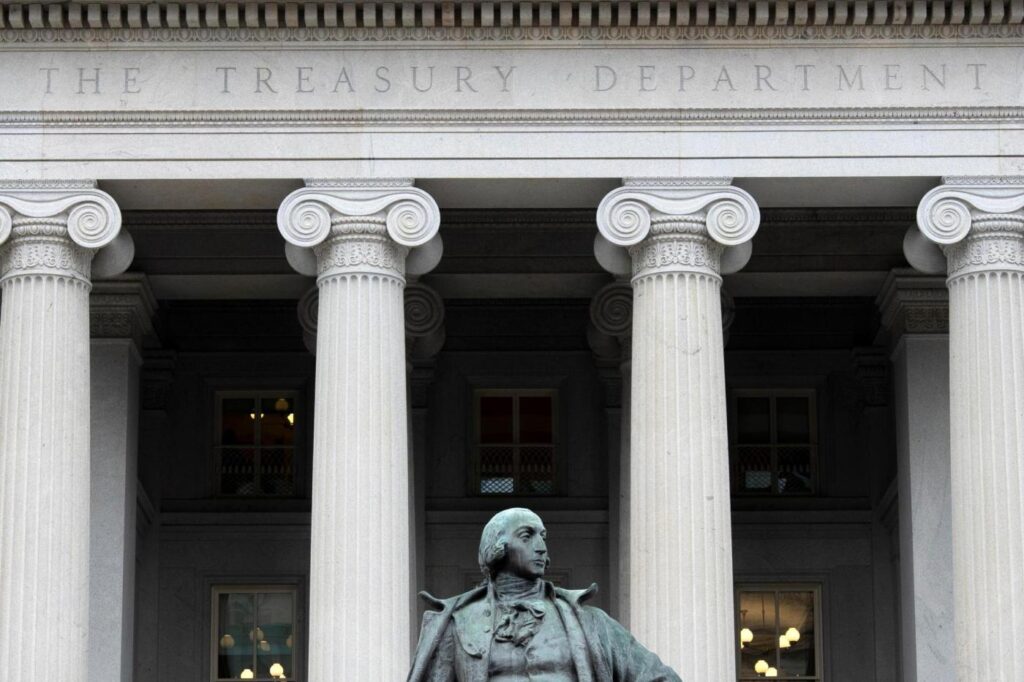

Three prominent Mexican financial institutions are grappling with severe economic repercussions following sanctions imposed by the Trump administration. The U.S. Treasury Department’s decision to block transactions involving CIBanco, Intercam Banco, and the brokerage firm Vector Casa de Bolsa has sent shockwaves through Mexico’s financial sector.

The sanctions, announced last week, accuse these institutions of facilitating money laundering operations for drug cartels, a claim that all three vehemently deny. The move has prompted a swift response from Mexico’s President Claudia Sheinbaum, who criticized U.S. officials for failing to provide concrete evidence to support their allegations.

Sanctions and Their Immediate Impact

The U.S. Treasury Department’s announcement detailed how funds were allegedly moved through accounts in the U.S. and transactions with Chinese companies, purportedly involved in supplying materials for fentanyl production. In response, Mexico’s banking authority has temporarily taken over the management of CIBanco and Intercam Banco to safeguard creditors.

President Sheinbaum assured that the Mexican government is committed to protecting creditors, emphasizing that they are “within their right” to withdraw their funds. The sanctions are set to take full effect 21 days after the announcement, leaving a narrow window for affected parties to adjust.

Financial Ratings and Market Reactions

The repercussions of the sanctions are already manifesting in the financial markets. Fitch Ratings has downgraded the three institutions and related affiliates, citing “anti-money laundering concerns” and the potential negative impact on their financial stability. The agency stated,

“The new ratings reflect the significantly more vulnerable credit profile of these entities in response to the aforementioned warnings.”

In a further blow, CIBanco announced that Visa Inc. had unexpectedly decided to sever its platform for all international transactions, a move the bank claims violates the 21-day grace period stipulated by the sanctions. CIBanco reassured its customers, stating,

“We would like to reiterate that your funds are safe and can be reimbursed through our branch network.”

Additionally, S&P Ratings has withdrawn CIBanco from its index, citing the termination of contracts following the U.S. Treasury’s announcement.

Historical Context and Expert Opinions

This development is reminiscent of past financial crises triggered by international sanctions. Experts draw parallels to the 2012 sanctions on Iranian banks, which led to significant disruptions in global oil markets and financial systems. Dr. Maria Lopez, a financial analyst at the University of Mexico, commented,

“The current situation underscores the fragility of financial institutions in the face of geopolitical pressures. The Mexican banks’ predicament is a stark reminder of the interconnectedness of global finance.”

The sanctions also highlight the ongoing battle against money laundering and drug trafficking, issues that have long plagued Mexico and its financial institutions. The U.S. has consistently pressured Mexico to strengthen its regulatory frameworks and combat illicit financial flows.

Future Implications and Next Steps

The immediate future for the sanctioned banks remains uncertain. The Mexican government is likely to intensify diplomatic efforts to resolve the crisis and mitigate its impact on the national economy. Meanwhile, affected banks must navigate the challenges posed by downgraded credit ratings and severed international partnerships.

Looking ahead, experts suggest that this incident could prompt a broader reassessment of Mexico’s financial regulatory environment. Strengthening anti-money laundering measures and enhancing transparency could be pivotal in restoring confidence among international partners.

As the 21-day deadline approaches, the financial world will be watching closely to see how Mexico’s banking sector responds to these unprecedented challenges. The outcome could have lasting implications for the country’s economic stability and its relationships with international financial institutions.

About The Author

Fireworks Ban Enforced at Buffalo National River for July 4th Celebrations

Fireworks Ban Enforced at Buffalo National River for July 4th Celebrations Fireworks Banned at Buffalo National River: National Park Service Issues Reminder

Fireworks Banned at Buffalo National River: National Park Service Issues Reminder Democrats Strategize to Counter Trump’s Controversial Tax Bill in House

Democrats Strategize to Counter Trump’s Controversial Tax Bill in House Senate Passes Controversial Tax Bill with JD Vance’s Tie-Breaking Vote

Senate Passes Controversial Tax Bill with JD Vance’s Tie-Breaking Vote Cleveland Guardians’ Gabriel Arias Avoids Major Injury, Placed on IL

Cleveland Guardians’ Gabriel Arias Avoids Major Injury, Placed on IL